Tax is something that all people, not just Filipinos, need to abide to. It’s where the government gets additional funds to build up and proceed with projects which are for the betterment of the country. Based on most recent data, only a total of thirty-four (34) percent of the total Philippine population are tax payers. In figures, it amounts up to 30,000 million Filipinos.

The Tax Reform for Acceleration and Inclusion (TRAIN Law) is the new tax regime that our country follows. Even if this is the case, some Filipinos still find it challenging to file their taxes because of the fact that it’s tedious. However, an application called JuanTax, will be an extremely effective solution to this.

Read: Lower Income Tax? That Means Higher Tax For Tobacco, Petroleum, And Sugar Products By 2018

What is JuanTax?

JuanTax is the digitized Business to Business (B2B) tax platform and tax automatic data entry which is accredited by the Bureau of Internal Revenue (BIR). It’s the newest cloud-based tax filling solution for taxpayers.

JuanTax founder, Marvin Galang, said that this application, with the help of current technology and Artificial Intelligence (AI), they were able to come up with a program that would fill out the forms using the data on receipts which are scanned using a camera from a smartphone.

How can I set-up my JuanTax account?

Using the web-based application is easy. As a matter of fact, it can be deduced to just three (3) simple steps. First and foremost, you need to register with JuanTax first. Click here to be redirected to the registration page.

After doing so, you can now start your journey in never feeling the hassle of filling out tax forms ever again!

Read: How Much Would the Tax of the P700-Million UltraLotto Winner be?

Uploading your information

After creating a JuanTax account, the first thing you would have to do is to set-up the information required. Some of these would include:

- Full Name

- Address

- Tax Identification Number (TIN)

- Contacts

- Contacts’ Address/es; and

- Your contacts’ TIN/s

You can upload them by importing the information through an Excel (CSV) spreadsheet. Finalize the information and double-check to avoid the hassle of coming back again to edit it.

Generate reports

The next easy step is to make a report of the tax return you want to file. After adding a report, select the Month and Year of the return; then you can now add the transactions to your report.

Read: HiDOK, a Mobile App for a Doctor’s Appointment, Now Out in Davao

Other than the fact that you can directly create transactions in JuanTax, you also have the choice to import transactions in bulk in CSV spreadsheets in the tax software. So, you have a load of options on how you can import the transactions.

It’s actually very easy! Should you have created a spreadsheet which contained your transactions, you can just upload it in JuanTax, map and align the columns and you’re set!

File your reports

Now that you’re ready to submit and file your returns, you can easily do it in just a few clicks! There actually are two (2) options available: eBIR Filing and Manual Filing.

Manual Filing refers to you viewing and printing your tax forms and submitting it manually to the nearest and respective Revenue District Office (RDO) in your location.

eFPS users can download the forms and enter it in the eFPS. Then, they can send the DAT files through JuanTax—the DAT files are already authenticated and validated.

eBIR Filing on the other hand, is when JuanTax files your tax forms electronically using eBIR v7.1. Doing so will allow the app to also send the DAT files relevant to your returns.

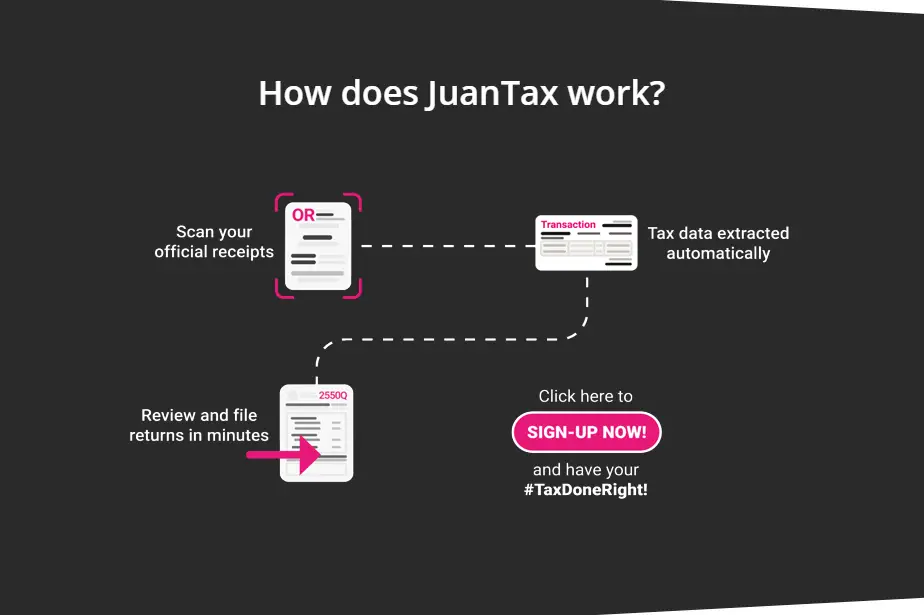

It’s easy! We can summarize the steps into the following:

- Scan your Official Receipts (ORs). Make sure that the information in the photo is clear;

- Your tax data will be extracted automatically into the cloud;

- The image will be reviewed and validated in a few minutes;

- You’re ready to go and file!

It’s easy, hassle-free, and convenient for all businesses and self-employed people.

Read: 12% Contribution Hike of SSS in 2019

Benefits of JuanTax

Some businesses find it such a hassle to file their taxes especially small businesses. With JuanTax, everything about tax-filing is made easier and better!

Some of the main benefits of JuanTax are:

Mobile application

It’s a web-based mobile application. As long as you have a working Internet connection, you can use this utility tool and take advantage of it.

Secured data

JuanTax is approved and accredited by the Bureau of Internal Revenue (BIR). All of the information are confidential and are properly secured; backed with two-factor authentication and a one-time pin.

Accountant’s portal

Accountants need not to worry anymore in switching between multiple windows and pages. Everything is in one dashboard including the clients compliance and other requirements.

Automated tax calculation

Everything is calculated automatically after taking a snapshot of the data. No more complicated templates that are complex. Recording and reporting is seamless.

Read: BPO Subsector: Special Tax Rate Removed?

Unlimited users

It can have unlimited users with no extra costs. Different users with different roles are available.

Unlimited storage

Since it’s archived in the cloud, you don’t have to worry about filing and uploading a ton of data or information.

Smooth filing

Different options vary. From Tax returns to VAT Relief, SAWT, and QAPs. It’s done and sent through the system which is secured and is moderated by the BIR.

Information on different BIR forms

If you need some information about the different BIR forms, you can also do it in the JuanTax web version. They will relay all of the information on the different forms like what it is for, who needs to file it, and how it can be filed.

This allows self-employed people and businesses to save time from calling or visiting the nearest RDO just to inquire. Here are the forms:

For Withholding Tax

For DAT Files

For Value Added Tax (VAT)

For Payment/s

For Income Tax

For Percentage Tax

Marvin Galang said that he knows what the challenges are in filing taxes since he is an accountant in profession. This is what urged him to come up with JuanTax to be able to assist and simplify the process of filing taxes.

I’m an accountant by profession and also a business owner so it was a firsthand experience as far as the challengers and the pain points in preparing a tax return when we designed the app.”

According to Galang, JuanTax is really a life-saver because filling out just one (1) BIR form usually takes somewhere around ten (10) minutes. Data from just one (1) receipt needs to be inputted to a total of eleven (11) forms; so that is 10 multiplied by 11.

A majority of JuanTax services are free. However, Galang mentioned that there are services that might cost and it can go up to just P6, 000.00 compared to availing different programs and software.

It’s available in both Android and iOS. Download now!